We are proud to welcome CCI Consulting to Keystone Partners.

-

Who You Are

-

What You Need

Get Certified

-

Resources

-

About Us

We are proud to welcome CCI Consulting to Keystone Partners.

Our proprietary organizational assessments are designed specifically for private equity sponsors. Our tools uncover hidden leadership risks, cultural misalignments, and executional gaps—before they impact returns. Whether pre-acquisition or post-close, our assessments deliver actionable insights that accelerate value creation, de-risk execution, and drive alignment between management and investor expectations.

"We invest millions in financial and legal diligence, but little in understanding the people leading the business. Organizational assessment isn’t just smart—it’s essential for de-risking leadership, culture, and execution, and for making better decisions from day one."

— Partner, Mid-Market, Private Equity Firm

70% of PE deals underperform due to leadership misalignment and cultural breakdowns

Our assessments measure the seven dimensions that directly influence deal performance, post-close execution, and long-term scalability.

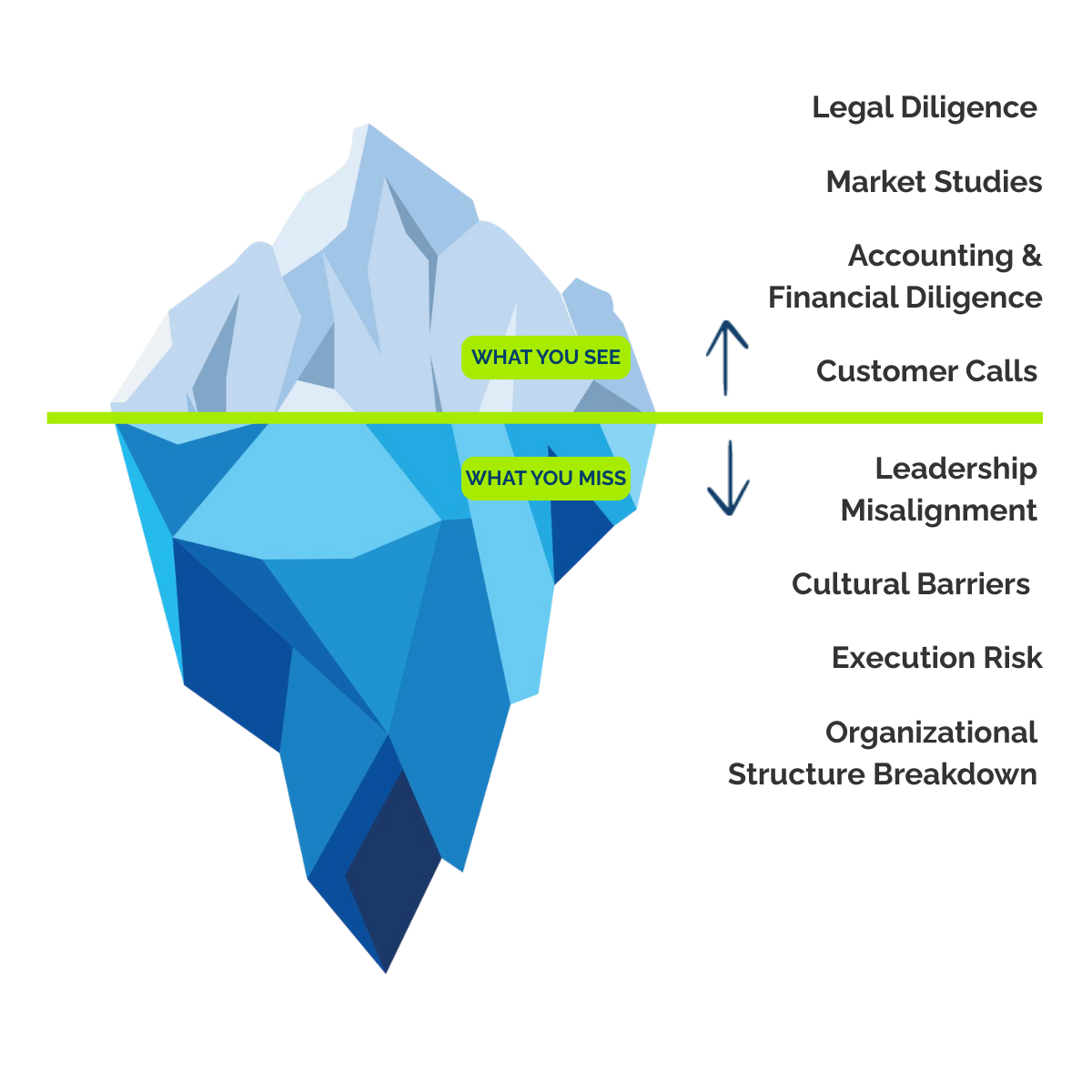

You can’t fix what you can’t see. Most private equity diligence misses the critical drivers of execution failure – our job is to uncover them before they cost you returns.

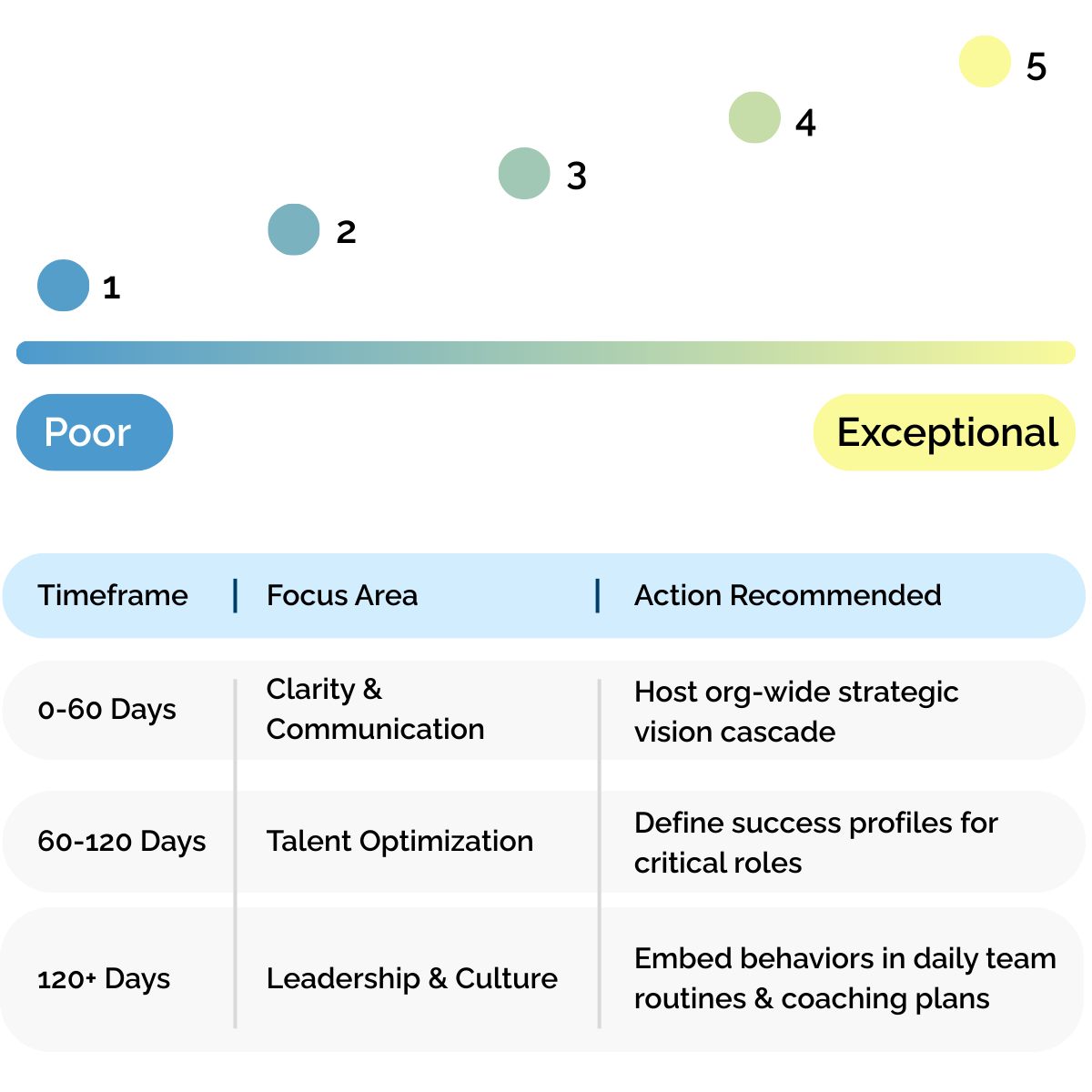

A Baseline Assessment can be delivered in less than two weeks and assesses execution ability, leadership readiness to create value and mitigate risk.

An average deal diligence can cost between $1.5M to $3M and an organizational assessment can cost less than $50K giving the organization a 15% EBITDA lift when completed early in the hold period.

Assess how leadership culture drives or hinders trust, accountability, and goal clarity – directly impacting EBITDA growth and IRR.

Evaluate where you have the right organizational structure, and the right people in the right seats to support scale, ownership and speed.

Reduce execution risk, increase integration success and measure cross-function trust and agility.

Uncover where performance may or has broken down and misaligned KPIs, low accountability or slow decision cycles that impact the bottom line.

While the assessment reveals hidden risks and opportunities, Keystone becomes your trusted partner, turning insight into excellence and an action guide towards future success.

Keystone Partners supports PE forms throughout the investment lifecycle, from pre-acquisition, post-acquisition and beyond.

The Comprehensive Assessment identifies leadership misalignment, cultural barriers, and organizational structure breakdown.

Every private equity investment is a bet on leadership. Are your executives ready to scale, execute, and drive results?

Let’s Discuss Your Leadership & Organizational Assessment Needs

The Assessment is a structured evaluation framework designed for private equity firms, leadership teams, and portfolio companies to assess executive leadership effectiveness, cultural alignment, and organizational execution capabilities.

It ensures that leadership teams are aligned, scalable, and performance-driven, supporting pre- and post-acquisition strategies for PE-backed firms.

The assessment evaluates leadership and culture based on private equity’s key investment criteria, including:

By identifying leadership gaps and cultural risks, PE firms can reduce investment risk and accelerate value creation post-acquisition.

| Assessment Level | Purpose | Best For |

|---|---|---|

| Baseline Assessment | Quick leadership & culture risk check pre-acquisition. | PE firms evaluating leadership risk before investment. |

| Comprehensive Assessment | Deep-dive leadership execution review post-acquisition. | PE-backed firms optimizing leadership effectiveness. |

| Assessment Level | Timeframe |

|---|---|

| Baseline Assessment | 1–3 weeks |

| Comprehensive Assessment | 2–4 weeks |

The assessment evaluates leadership and culture based on private equity’s key investment criteria, including:

Leadership misalignment is one of the top reasons acquisitions fail. Our model helps PE firms identify gaps early to avoid costly leadership mistakes post-acquisition.

Studies show that companies with strong leadership alignment post-acquisition see 20-30% faster operational improvements.

| Output | Baseline | Comprehensive |

|---|---|---|

| Executive Leadership Effectiveness Report | YES | YES |

| Culture & Organizational Risk Summary | YES | YES |

| Pre-Acquisition Readiness Scorecard | YES | – |

| Leadership Alignment Matrix | – | YES |

| Engagement, Execution & Performance Dashboard | – | YES |

| Long-Term Leadership Development Roadmap | – | YES |

The assessment evaluates leadership effectiveness across:

Each competency is benchmarked against high-performing PE-backed companies for industry relevance.

The Organizational Assessment leverages:

Each tool is tailored to support leadership execution, alignment, and cultural scalability.

PE firms using leadership assessments see 30% stronger EBITDA growth in post-acquisition years.

| Feature | Organizational Assessment | Traditional HR Assessment | Executive Coaching Programs |

|---|---|---|---|

| PE-Specific Leadership Metrics | YES | NO | NO |

| Pre & Post-Acquisition Focus | YES | NO | PARTIAL |

| Culture + Execution Alignment | YES | NO | LIMITED |

| Benchmarking Against PE Leaders | YES | YES | NO |

| Long-Term Leadership Impact Tracking | YES | YES | LIMITED |

Schedule a consultation today to explore the right assessment for your needs.

By reducing leadership misalignment risk, improving execution speed, and scaling culture effectively, the Organizational Assessment delivers measurable value to private equity firms.